- Safiu Kehinde

The Nigerian Exchange Limited (NGX) has confirmed the listing of an additional 3.16 billion ordinary shares of United Bank for Africa (UBA) Plc, to its Daily Official List.

This, as contained in a statement issued on Wednesday by UBA, signaled a major enhancement of the bank’s market capitalisation whilst also deepening liquidity on the capital market.

According to the statement, the NGX had last week issued a confirmatory letter to the bank.

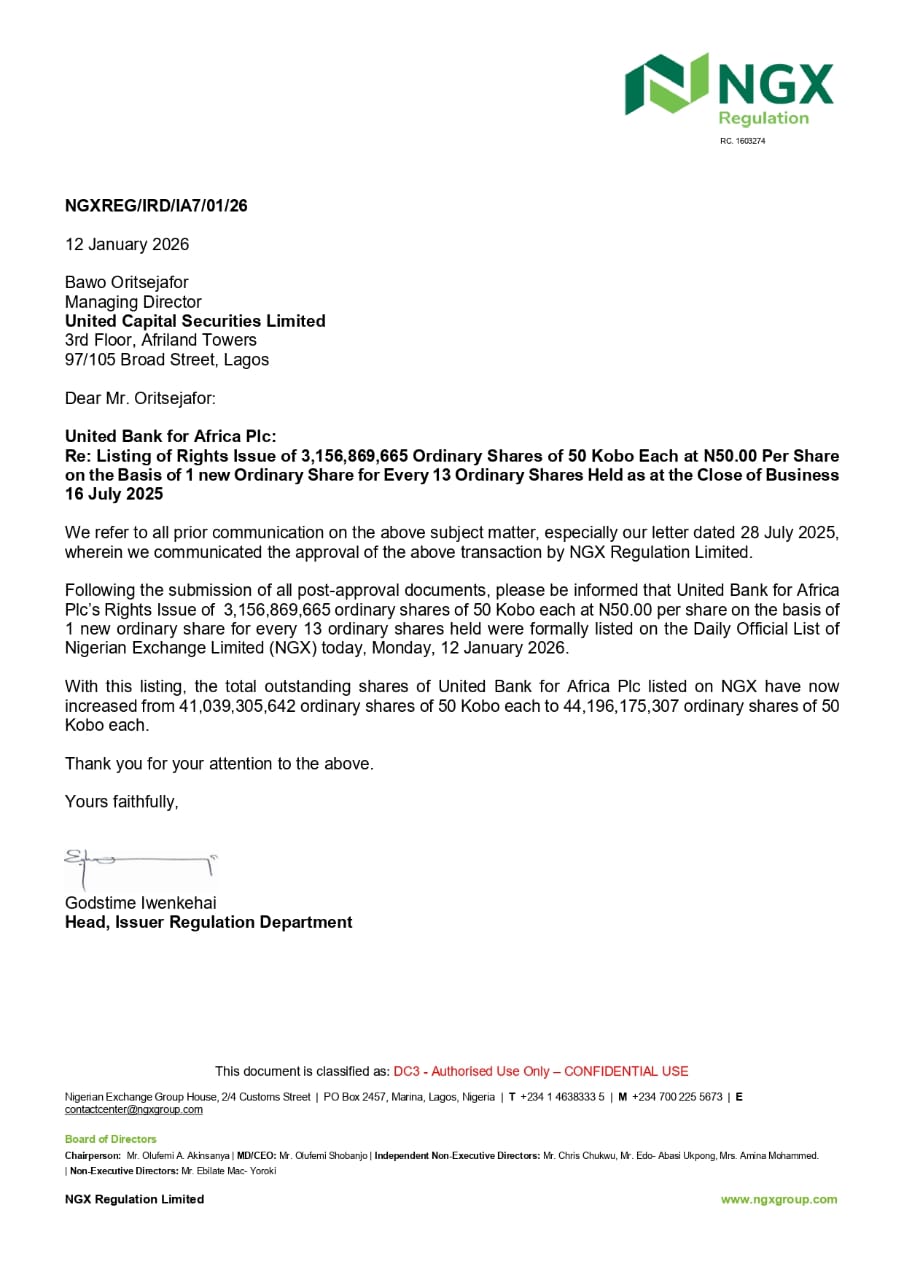

As contained in the letter dated January 12, 2026, and signed by Head, Issuer Regulation Department at NGX, Godstime Iwenkehai, the additional shares were listed following the successful conclusion of UBA’s recent rights issuance exercise.

“Following the submission of all post-approval documents, please be informed that United Bank for Africa Plc’s Rights Issue of 3,156,869,665 ordinary shares of 50 Kobo each at N50.00 per share on the basis of one new ordinary share for every 13 ordinary shares held were formally listed on the Daily Official List of Nigerian Exchange Limited (NGX) on , Monday, 12 January 2026”, Iwenkehai stated in the letter.

UBA’s Group Managing Director/CEO, Oliver Alawuba, who received the letter, commended the confirmation, as he noted that the move underscores robust investor confidence in the bank’s capitalisation strategy and future prospects.

He described the accomplishment as a reflection of strong investor confidence in UBA.

“We welcome the formal confirmation from NGX on the listing of our rights issue shares.

“This successful transaction reflects strong investor confidence in UBA’s financial strength, governance, and growth strategy.

“Needless to say, that the additional capital will further support our Pan-African and global expansion and enhance our capacity to deliver sustainable value to all stakeholders,” Alawuba stated.

In November 2024, the bank had raised N239 billion, which elevated its capital base to N355 billion at that time, while the recently concluded rights issue has injected an additional N158 billion, bringing the bank’s total capital to N513 billion.

The latest influx, according to the statement, means UBA’s qualifying capital base now surpasses the N500 billion requirement by the Central Bank of Nigeria (CBN), thereby exceeding the recapitalisation minimum for banks with international authorisation.