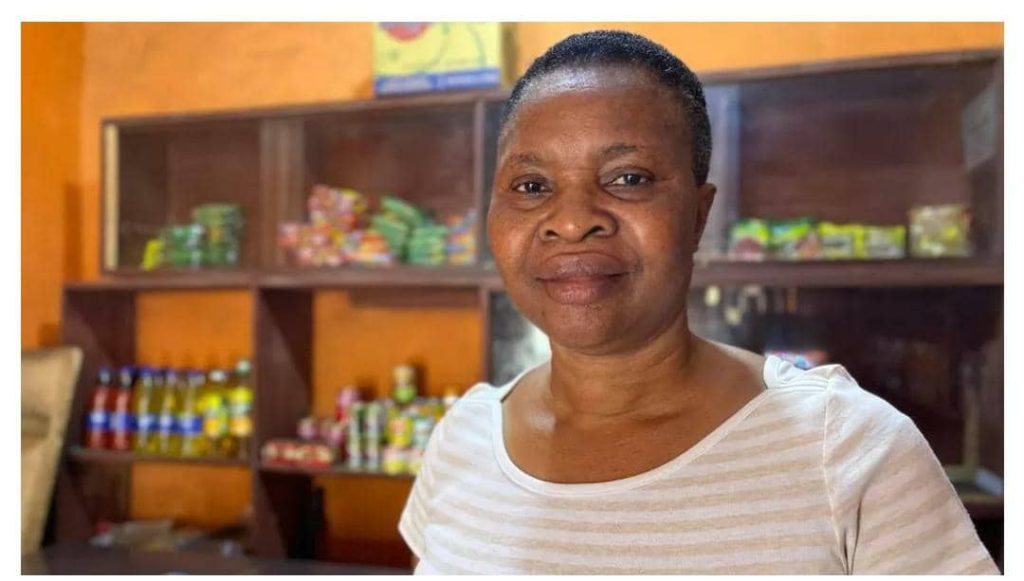

Arinola Omolayo owns a frozen food store in Ogba, a suburb of Lagos, Nigeria’s commercial nerve centre, where she sells mostly imported chicken, fish and turkey.

She says she used to be happy coming to the shop, “but now I feel reluctant”.

The reason is the soaring price of food. Frozen chicken now costs about 3,400 naira ($4; £3.50) per kilo – an increase of more than 26% in the past three months.

“Customers that used to buy 1kg of fish or chicken now ask for half a kilo… my bigtime customers I usually supply… 3-4kgs, now they barely buy 1kg,” she says.

Her suppliers blame the increase in the US dollar for the price rises, she says, adding it has made her goods very difficult to sell.

Food, transport and commodity prices in Nigeria have been forced higher by a fall in the naira – which has caused a spike in foreign exchange rates and driven up inflation.

Nigeria’s not alone. Most Sub-Saharan African currencies are getting weaker against other global trading currencies like the pound sterling and the US dollar, resulting in the loss of value and purchasing power of these local currencies on the continent.

The naira fell nearly 40% against the US dollar between 31 December 2022 and 15 September 2023

In October, the World Bank published a report in which it said the currencies in Nigeria and Angola, Africa’s biggest oil producers, were the two worst performing on the continent.

The naira and the kwanza lost nearly 40% of their value against the US dollar between 31 December 2022 and 15 September 2023.

“The weakening of the naira was triggered by the central bank’s decision to remove trading restrictions on the official market,” the World Bank said.

“For the kwanza, it was the decision of the central bank to stop defending the currency as a result of low oil prices and greater debt payments.”

The report listed other African currencies that fell significantly over the same time frame, including those in South Sudan (33%), Burundi (27%), the Democratic Republic of Congo (18%), Kenya (16%), Zambia and Ghana (12%) and Rwanda (11%).

In Zambia, Africa’s copper capital, the price of staple foods, including maize, meat, fish and the popular dried pumpkin leaves, has increased by more than 14% in the past five months.

In some cases prices have doubled, pushing products out of the reach of some in a country where more than 60% of the 20 million population are classified as poor, according to the country’s statistics agency. Many people survive on less than $2 a day.

Why are these currencies plummeting?

The huge gap between supply and demand for foreign currencies in these countries is one major issue.

Once there is a shortage of foreign exchange, people have to turn to alternative sources, such as the black market.

Black market rates are always worse than official rates meaning only wealthy companies and individuals can afford to use them for imports, raw materials, tuition, medical expenses, tourism and so on.

Another factor is the huge reliance on imports, a common factor among many African nations.

Many African countries import way more finished goods than they export. As a result, they need foreign currencies like the US dollar or the Chinese yen to pay the international suppliers of those goods, increasing demand for foreign exchange, and reducing the reliance on the local currency.

The dollarisation of the economy is not uncommon in parts of the continent.

In countries like Sierra Leone, some goods and services are priced in US dollars at grocery stores, thereby increasing the demand for dollars and reducing demand for the leone, the local currency.

How does it affect people?

Foreign exchange scarcity or higher exchange rates force manufacturers to pay more to import their raw materials, which increases the cost of production.

Fuel is just one of the items that has been soaring in price

In most cases, the final consumer bears the additional costs via increased prices in the shops and higher transport costs.

Businesses suspend operations and investors take fright when they cannot retrieve their money in foreign currency from the central bank.

One such example is Emirates Airlines. It suspended operations in Nigeria for more than a year after it found it could not repatriate $85m in funds from ticket sales trapped in the country.

The International Air Transport Association said altogether carriers had $812m stuck in Nigeria, more than any other country – and almost half of the total worldwide.

Of course, you might think oil producing countries like Nigeria and Angola would have vast amounts of money and foreign exchange since oil is sold in US dollars.

However, their governments have run up huge debts that need to be serviced and which eat up foreign currency reserves. Many countries also use up vast amounts of money heavily subsidising local fuel and energy prices.

As a result, these countries don’t really benefit from the soaring oil prices in the global market.

What are governments doing?

Nigeria’s central bank announced it would inject $10bn worth of foreign exchange into the market, mainly sourced from crude oil sales and foreign investments.

This will be used to pay foreign exchange debts that were previously impossible to settle because of limits on how much foreign exchange could be used.

Africa’s largest economy also lifted the ban on 43 imported items, including rice, cement and steel products, which people had previously been barred from using foreign currency to buy.

That had meant such importers turned to the black market, forcing up prices.

The aim of the relaxation is to reduce demand for foreign currency, but it’s opposed by local manufacturers who fear it will undermine their competitiveness.

Neighbouring gold-rich Ghana implemented its “gold for oil” policy late last year. The government uses gold instead of cash to buy oil. The idea is to reduce pressure on the weak Ghana cedi and bring in cheaper fuel in exchange for gold.

So far the scheme has saved the country about $5bn in foreign reserves, the government said in August.

Egypt has requested a barter agreement with the world’s biggest exporter of black tea, Kenya. This involves exchanging goods for goods, while Egypt saves its foreign reserves, relying less on the US dollar.

Muda Yusuf says African countries need to trade more with each other to support local currencies.

Earlier this month, Zambia’s central bank said it would increase the amount of foreign currency deposits that banks must hold, in an effort to build up the country’s foreign exchange reserves, and support the value of the local kwacha currency.

The impact of the weak local currencies has sparked renewed debate about the full implementation of the Continental Free Trade Agreement (AfCFTA) as a way of ditching reliance on foreign currencies to trade.

Established in 2018 AfCFTA aims to create a single market for goods and services and boost intra-African trade and investment. Once it’s fully up and running it will be the biggest free trade area in the world in terms of population, covering a market of 1.3 billion people.

Muda Yusuf, a director at the Centre for the Promotion of Private Enterprise in Nigeria says African nations need to trade with each other and buy locally made goods to support the local currencies.

Spiralling prices have hit Arinola Omolayo’s business

But to match global standards in goods and services Africa must “strengthen productivity and competitiveness, both in price and quality”, he says.

The lack of infrastructure also makes it more difficult to trade within Africa.

“The continent has weak connectivity by rail and road, which are more important than air travel, because of the volume of trade. This must be prioritised to actualise the continental free trade agreement,” Mr Yusuf says.

Back in Lagos it’s clear just how badly soaring prices have damaged business in Arinola Omolayo’s shop.

While we were talking, no customers stopped by to buy anything.

“If it was when I was busy with sales, I won’t even have the time to grant you this interview,” she says.

Credit: BBC