*Nigerians Call for Quick Resolutions

By Halimah Olamide and Kamil Opeyemi

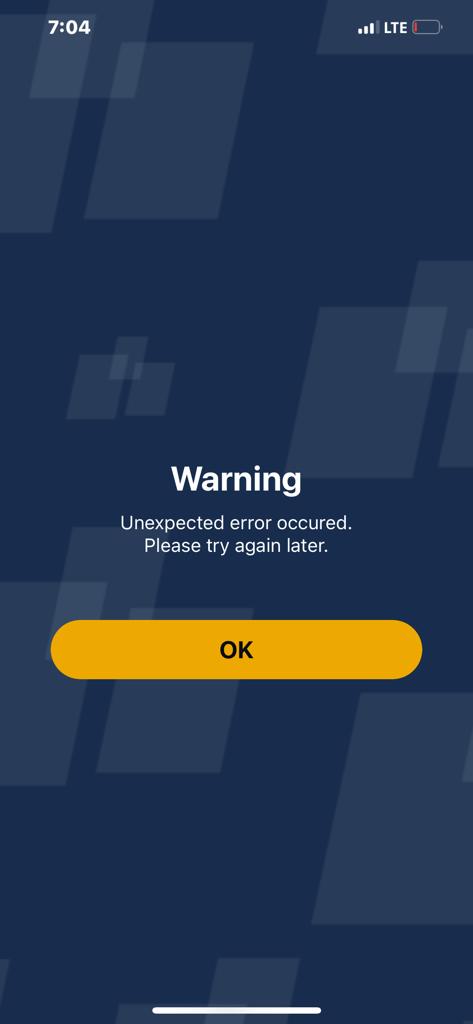

It has been one weekend of hardship for Nigerians as the digital Apps of most banks collapsed making transactions near impossible.

The Apps have collapsed amidst scarcity of Naira which has thrown the country into chaos.

“Transfers are almost impossible and PoS operators are unable to get their machines to work,” said Mrs. Durodola Adegbami who spoke with the NPO Reports correspondent at a daily need store in Lagos on Saturday.

PoS operators say they have become frustrated with the inability to get transactions through as their machines keep being unable to connect.

Mrs. Agnes Ikechukwu, a PoS operator at Ogba, Lagos told the NPO Reports that only her Access Bank PoS machine has worked once in about six hours of opening for business on Saturday.

Most shops visited by the NPO Reports correspondent showed on Saturday that there were congestions as many customers had difficulties making payments.

A supermarket at the GRA Ikeja had a long queue of buyers who were finding it difficult to make transfers or use the PoS machines.

A staff of Zenith Bank who however pleaded not to be named because he is not authorised to speak on behalf of the bank said the internet banking infrastructure of the bank is being reviewed for more efficient service in the face of the current challenges.

“I think no one anticipated this huge option for the online option. Obviously, the shift to either PoS or internet banking has made a nonsense of the existing infrastructure,” he said Sunday morning.

It was observed that in some cases, the development cause tensions and, in few cases, attacks.

A man who claimed that his bank account had been debited at a popular supermarket in Ikorodu created a scene on Friday when the salesgirl insisted that the transaction had not been completed and the customer could not leave.

An eyewitness to the scene told the NPO Reports that the man forcefully tried to leave the supermarket with his purchased goods only to be stopped by security men.

This, according to eyewitness led to physical fight with the customer dealing one of the security guards slaps.

While expressing sympathy with Nigerians last week on the hardship being faced, the Association of Corporate Affairs Managers of Banks (ACAMB) had listed how Nigerian banks invested fortune of getting the needed infrastructure for digital baning.

Rasheed Bolarinwa, its President, had said in a statement “Nigerian Banks have invested an estimated total sum in excess of N100 billion in setting up and maintaining cutting-edge electronic channels over the past few years as part of ongoing commitment to seamless customer experience and real time digital financial transactions.

From internet banking to mobile apps, Automated Teller Machines (ATMs), Point of Sales (PoS) merchants, mobile wallets, Unstructured Supplementary Service Data (USSD) codes, agents and digital franchises among others; not less than 80 per cent of Nigerians now enjoy one form of digital or cashless transaction or another, powered by investments by Nigerian Banks.”