By Halimah Olamide

By Halimah Olamide

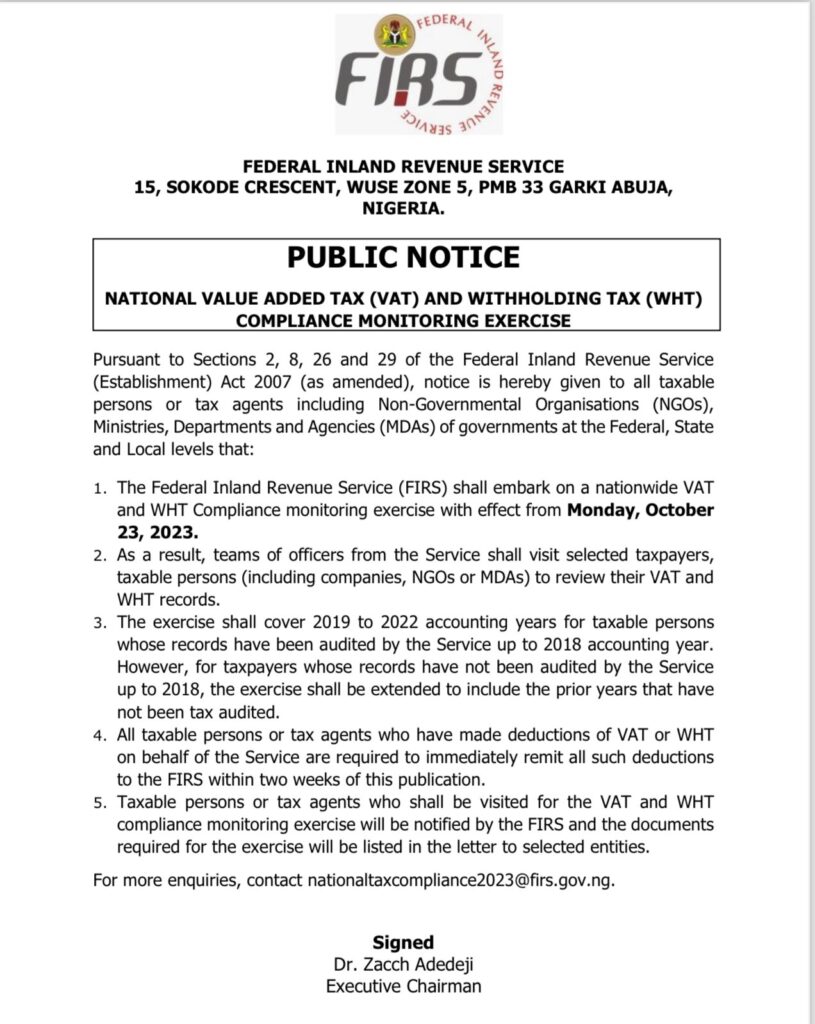

Tax defaulters are in for a rough deal as from next week as the Federal Inland Revenue Service (FIRS) is set to commence a nationwide Value-Added Tax (VAT) and Withholding Tax (WHT) compliance monitoring exercise for all taxable individuals.

As from October 23, FIRS in a statement released to the media said by the Acting Executive Chairman of the FIRS, Dr. Zacch Adedeji, said the initiative is targeted at improving tax compliance and revenue collection across the country.

VAT is a consumption tax applied to a product when value is added at various points in the supply chain, starting from production and ending at the point of sale.

The WHT on the other hand, is deducted at the source by organisations or entities when making payments to suppliers of goods and services.

The entities are mandated to pay the deducted amounts to the tax authority during payments to suppliers or vendors.

Adedeji said the monitoring exercise is in accordance with the FIRS Act of 2007 adding that it is intended to widen the tax net.

The FIRS Acting Executive Chairman clarified that for taxpayers whose records have not been audited by the agency up to 2018, the exercise will be extended to include the preceding unaudited years.

According to the statement, taxable individuals or tax agents who are subject to the VAT and WHT compliance monitoring initiative will be duly notified by the FIRS, and the necessary documents and requirements for the exercise will be outlined in the communication sent to the selected entities.

See the FIRS Statement Below: